NEWS & PUBLICATIONS

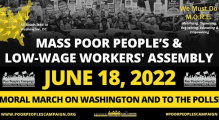

On Saturday, June 18, people from all across the country are coming together to mount a challenge against the interlocking injustices of systemic racism, poverty, the war economy, ecological

We are happy to present our Annual Report for the 2021-2022 church year.

Cedar Lane is currently searching for an Assistant Minister to support the overall ministry of the congregation, with a special focus on multicultural ministry, membership engagement, pastoral care, and worship.

We are happy to present our Annual Report for the 2019-2020 church year.

Doña Rosa and Rev. Katie Romano Griffin were interviewed for a video produced by the Immigrant Food restaurant in Washington, DC.

Learn about ongoing programming and upcoming worship services in our June 2020 Program Booklet!

Please email Ashley Del Sole (adelsole@cedarlane.org) with your submission requests for the July edition.

Empower, Connect, and Inspire. These are the words that sum up the philosophy of religious education for Tim Atkins, the new Director of Lifespan Religious Education recently selected by Cedar Lane’s DLRE Search Committee and unanimously approved by the Board of